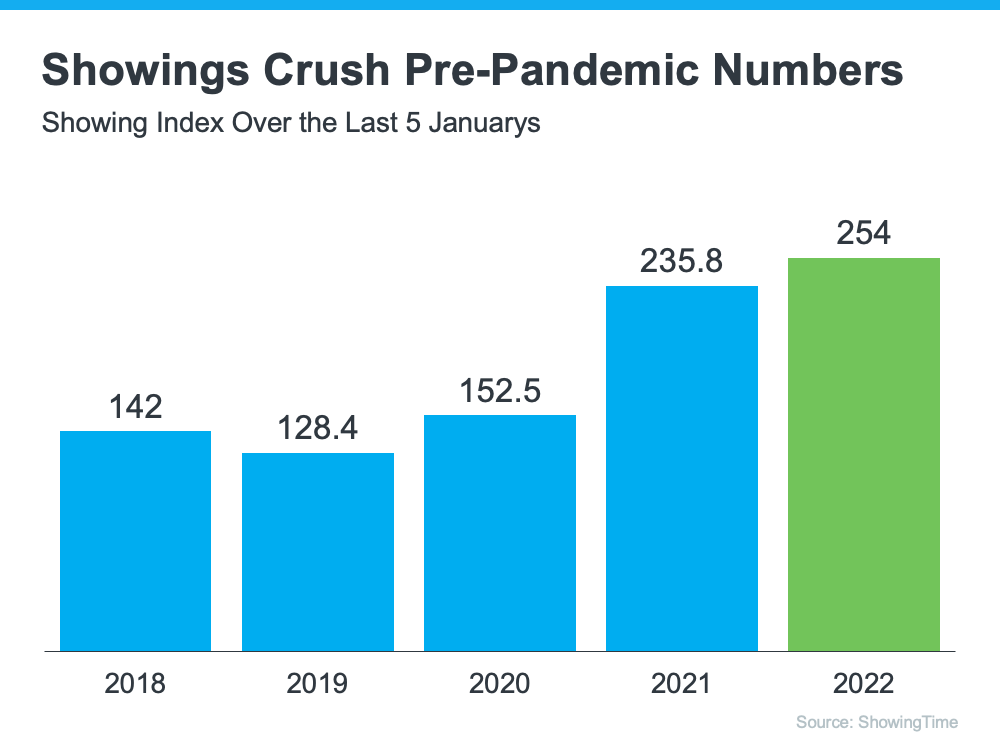

Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more than a quarter of a point from just a week ago. Here’s a visual to show how mortgage rate movement throughout 2021 was steady compared to the rapid increase in mortgage rates this year:

Just a few months ago, Freddie Mac projected mortgage rates would average 3.6% in 2022. Earlier this month, Fannie Mae forecast mortgage rates would average 3.8% in 2022. As the chart above shows, rates have already surpassed those projections.

Sam Khater, Chief Economist at Freddie Mac, explained in a press release last week:

“This week, the 30-year fixed-rate mortgage increased by more than a quarter of a percent as mortgage rates across all loan types continued to move up. Rising inflation, escalating geopolitical uncertainty and the Federal Reserve’s actions are driving rates higher and weakening consumers’ purchasing power.”

Where Are Mortgage Rates Going from Here?

In a recent article by Bankrate, several industry experts weighed in on where rates might be headed going forward. Here are some of their forecasts:

Greg McBride, Chief Financial Analyst, Bankrate:

“With inflation figures continuing to surprise to the upside, mortgage rates will remain above 4.0% on the 30-year fixed.”

Nadia Evangelou, Senior Economist and Director of Forecasting, National Association of Realtors (NAR):

“While higher short-term interest rates will push up mortgage rates, I expect some of this impact to be mitigated eventually through lower inflation. Thus, I expect the 30-year fixed mortgage rate to continue to rise, although we aren’t likely to see the big jumps that occurred over the past few weeks.”

Len Kiefer, Deputy Chief Economist, Freddie Mac:

“Mortgage rates are likely to continue to move higher throughout the balance of 2022, although the pace of rate increases is likely to moderate.”

In a recent realtor.com article, another expert adds to the conversation:

Danielle Hale, Chief Economist, realtor.com:

“. . . As markets digest the Fed’s updated economic projections, I anticipate a continued increase in mortgage rates over the next several months. . . .”

What Does This Mean for You if You’re Looking To Buy a Home?

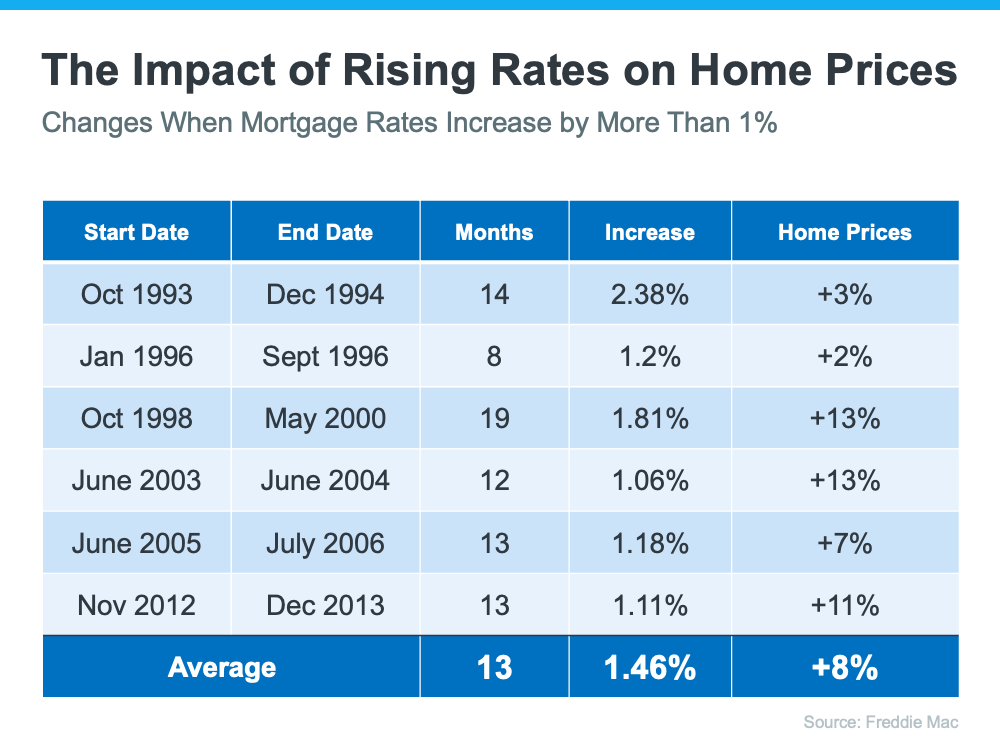

With both mortgage rates and home values expected to increase throughout the year, it would be better to buy sooner rather than later if you’re able. That’s because it’ll cost you more the longer you wait. But, there is a possible silver lining to buying a home right now. While you’ll be paying a higher price and a higher mortgage rate than you would have last year, rising prices do have a long-term benefit once you buy.

If you purchase a home today valued at $400,000 and put 10% down, you would be taking out a $360,000 mortgage. According to mortgagecalculator.net, at a 4.42% fixed mortgage rate, your mortgage payment would be $1,807 a month (this does not include insurance, taxes, and other fees because those vary by location).

Now, let’s put that mortgage payment into a new perspective based on the substantial growth in equity that comes with the escalation in home prices. Every quarter, Pulsenomics surveys a panel of over 100 economists, investment strategists, and housing market analysts about their expectations for future home prices in the United States. Last week, Pulsenomics released their latest Home Price Expectation Survey. The survey reveals that the average of the experts’ forecasts calls for a 9% increase in home values in 2022.

Based on those projections, a $400,000 house you buy today could be valued at $436,000 by this time next year. If you break that down, that means the equity in your home would increase by $3,000 a month over that period. That’s greater than the estimated monthly payment above. Granted, the increase in your net worth is tied to the home, but it is one way to put the home price appreciation to use in a way that benefits you.

Bottom Line

Paying a higher price for a home and a higher mortgage rate can be a difficult pill to swallow. However, waiting will just cost you more. If you’re ready, willing, and able to buy a home, now will be a better time than a year, or even six months from now. Let’s connect to begin the process today.

Source: KCM

![How an Energy Efficient Home Can Be a Bright Idea [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/03/23164059/20220325-KCM-Share-549x300.png)

![How an Energy Efficient Home Can Be a Bright Idea [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/03/23164100/20220325-MEM.png)

![Spring Cleaning Checklist for Sellers [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/03/16145923/20220318-KCM-Share-549x300.png)

![Spring Cleaning Checklist for Sellers [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/03/16145925/20220318-MEM.png)