Buying a home is a powerful decision, and it remains at the heart of the American Dream. Unlike renting, owning a home means more than just having a place to live – it offers a sense of belonging, stability, and freedom. According to Nicole Bachaud, Senior Economist at Zillow:

“The American Dream is still owning a home. There’s a lot of pent-up demand for ownership; that isn’t going to go away.”

Let’s explore just a few of the reasons why so many Americans continue to value homeownership.

The Financial Benefits of Owning a Home

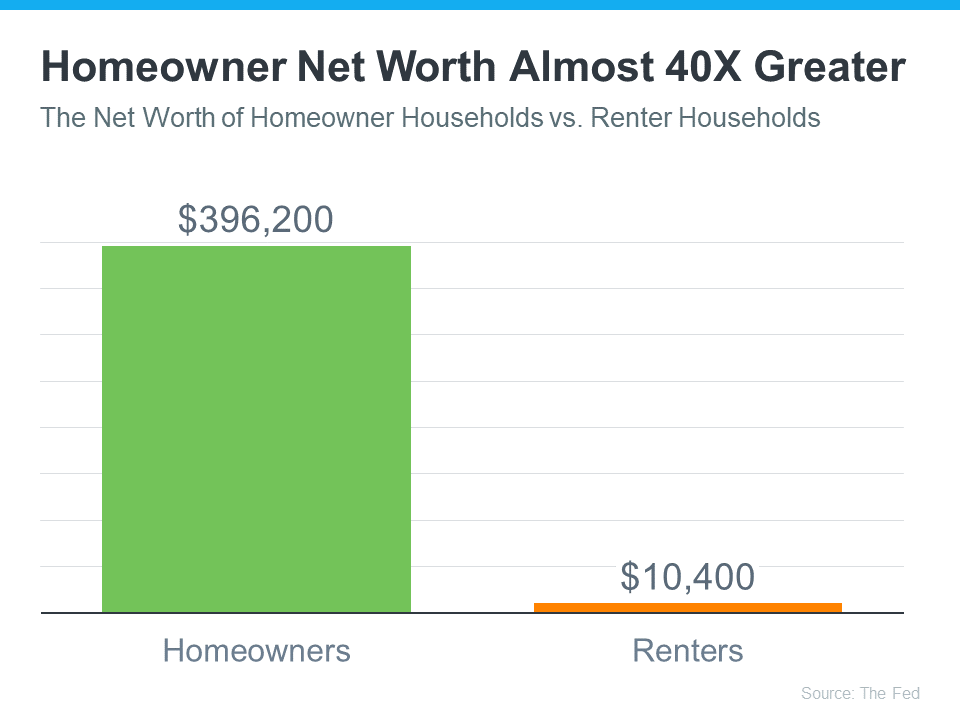

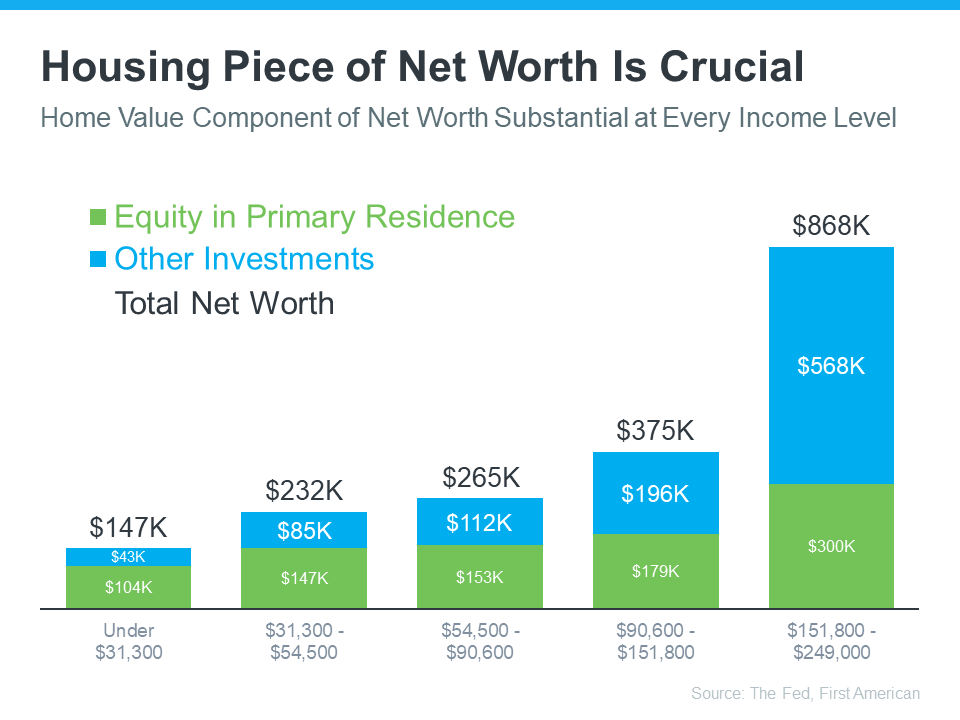

One possible reason homeownership is viewed so highly is because owning a home is a significant wealth-building tool. That may be why Jessica Lautz, Deputy Chief and VP of Research at the National Association of Realtors (NAR), says:

“Homeownership is the number one way to build wealth in America.”

Over time, owning a home not only helps boost your own net worth, but it also sets future generations up for success as you pass that wealth down. Habitat for Humanity explains:

“Overall, homeownership promotes wealth building by acting as a forced savings mechanism and through home value appreciation. Homeowners make monthly payments that increase their equity in their homes by paying down the principal balance of their mortgage. . . . In addition, owning a home promotes intergenerational homeownership and wealth building. Children of homeowners transition to homeownership earlier — lengthening the period over which they can accumulate wealth . . .”

It can also provide meaningful financial stability compared to renting. When you buy with a fixed-rate mortgage, you can lock in your monthly housing payments for the length of your home loan.

The Non-Financial Benefits of Homeownership

But, owning a home offers more than just financial benefits—it benefits you socially and emotionally too. Your home provides feelings of achievement, responsibility, and more. In a recent survey, Fannie Mae outlines just a few of these more emotionally-driven benefits, including:

“The top three were having control over what you do with your living space (94%) to having a sense of privacy and security (91%) and having a good place for your family or to raise your children (90%) . . .”

What Does That Mean for You?

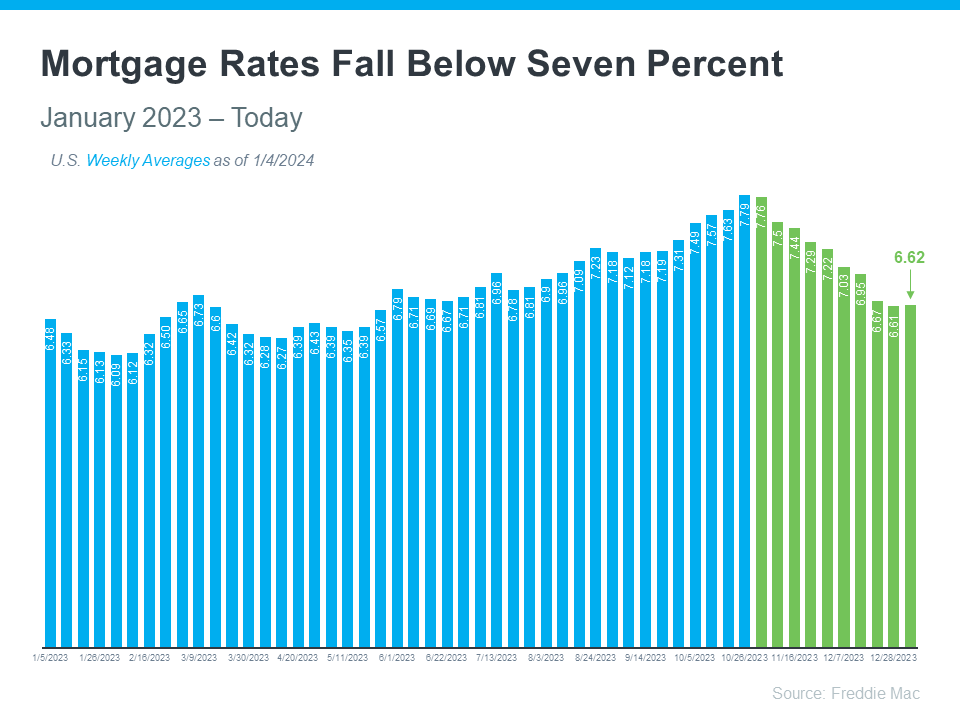

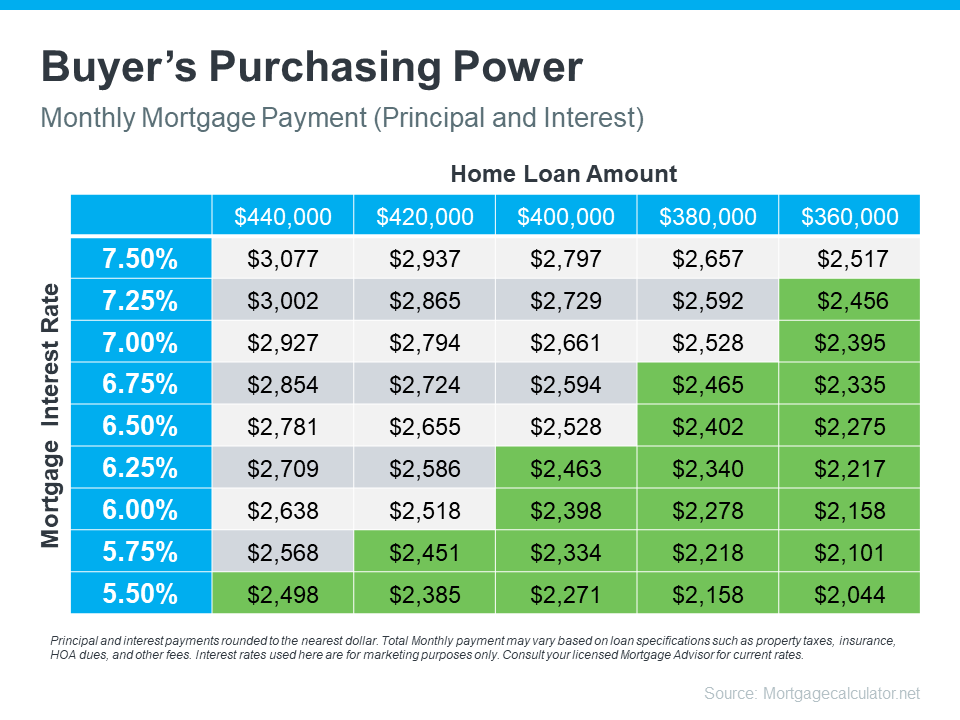

If your idea of the American Dream involves greater freedom, security, and prosperity, homeownership could be a key player in bringing that dream to life. And with mortgage rates now on a downward trend, it might be a good time for you to consider making a move.

If you’re ready and able to buy, know that there are incredible benefits waiting at the end of your journey. You’ll gain more than just a home – it’s a place to grow your wealth and call your very own. Like Ksenia Potapov, Economist at First American says:

“…homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

Bottom Line

Buying a home is a powerful decision and the cornerstone of the American Dream. If finding a place to call your own is part of your dream for this year, connect with a local real estate advisor to start the process today.

Source: KCM

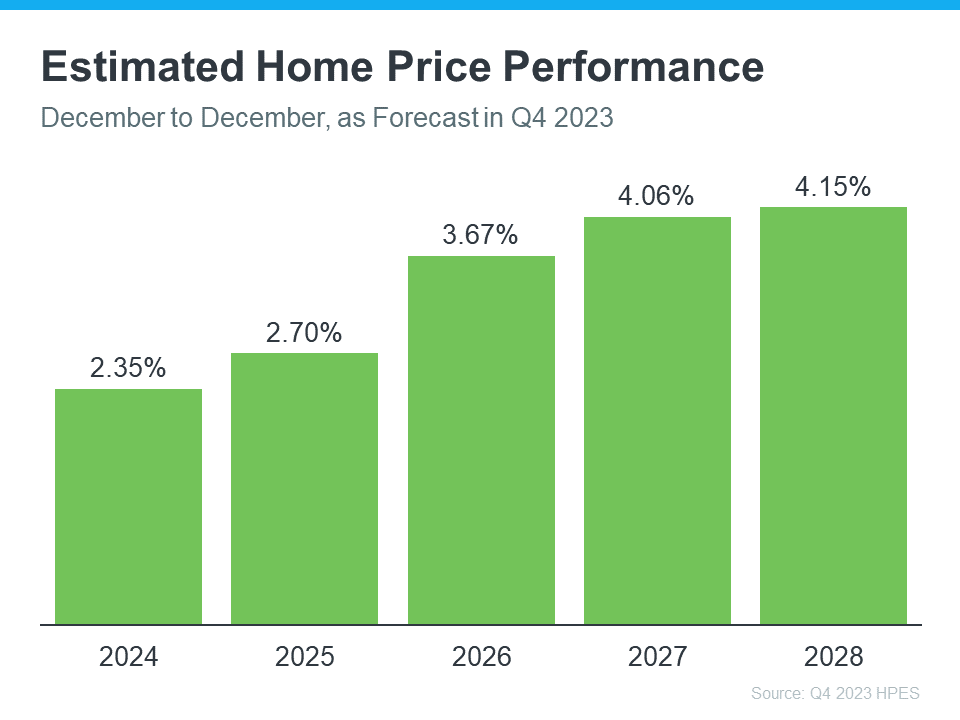

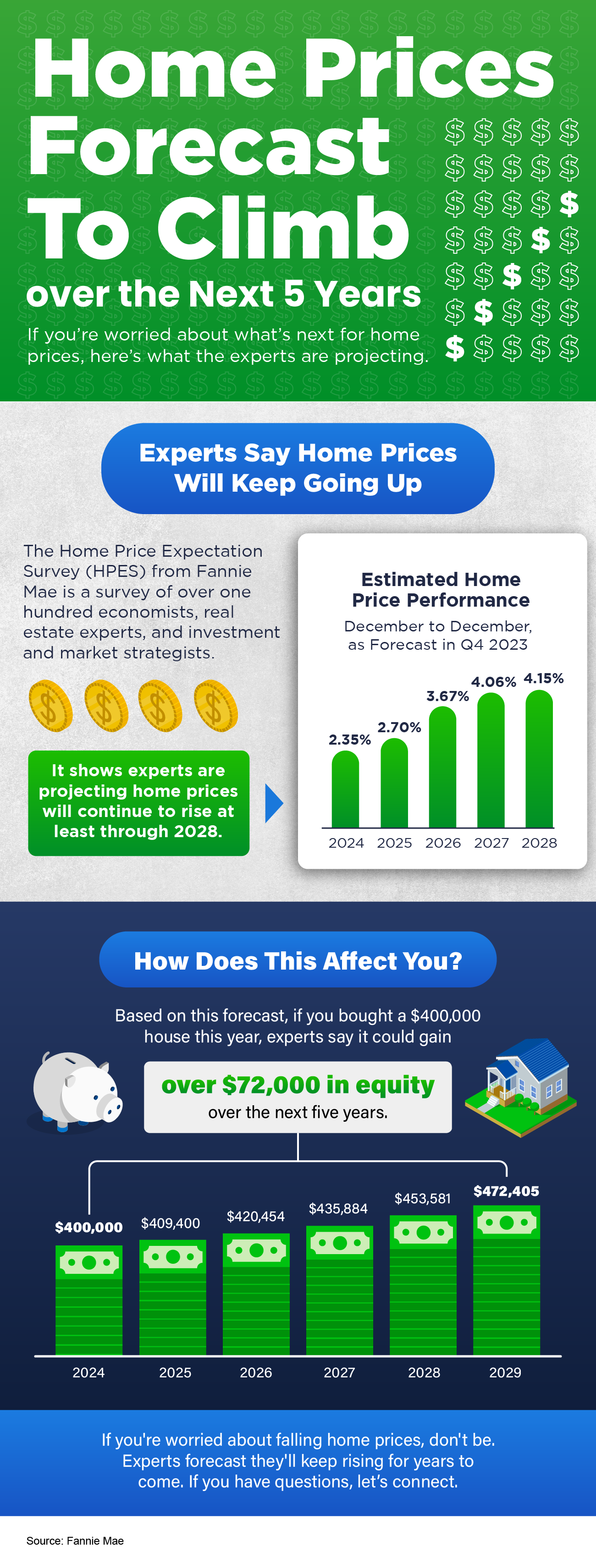

![Home Prices Forecast To Climb over the Next 5 Years [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240111/20240112-Home-Prices-Forecast-To-Climb-Over-The-Next-5-Years-KCM-Share.png)

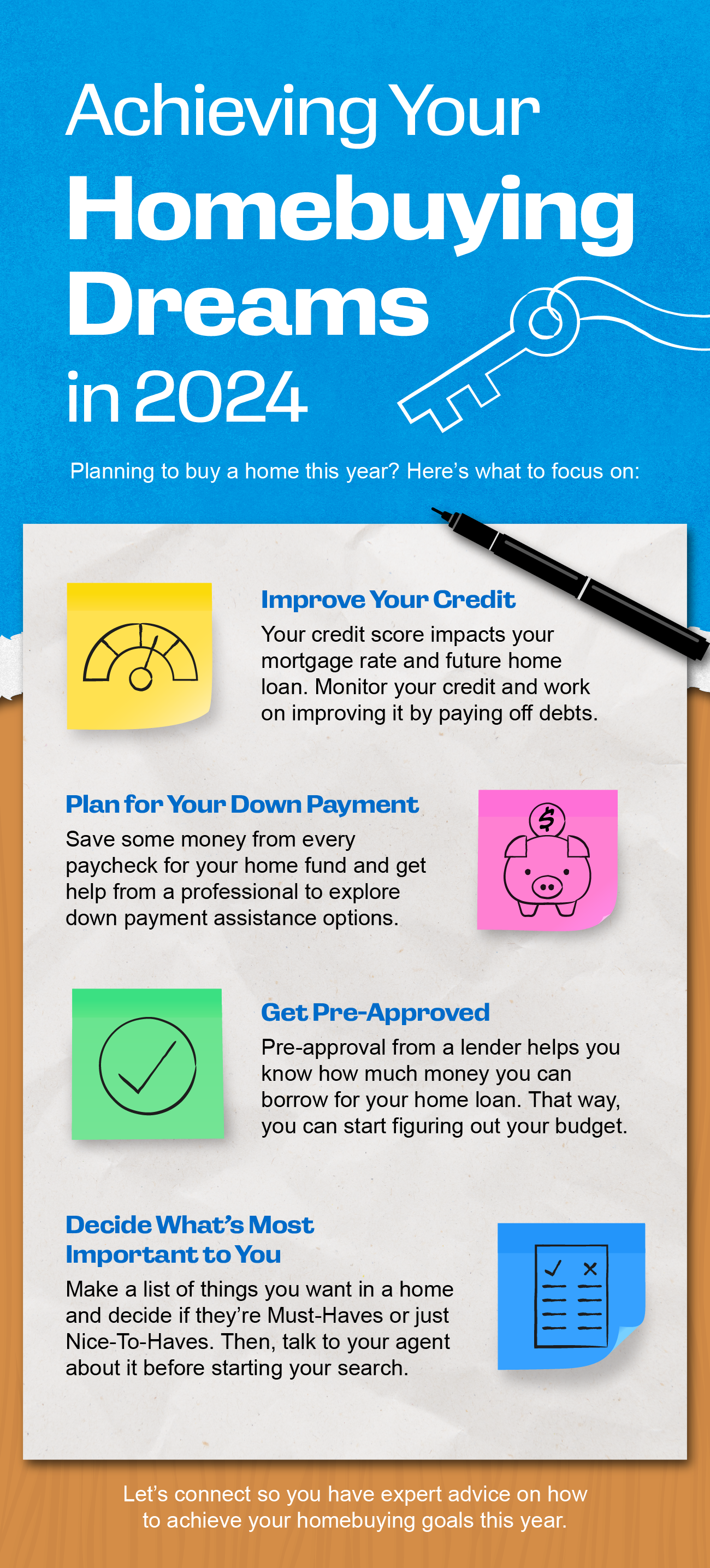

![Achieving Your Homebuying Dreams in 2024 [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240104/Achieving-Your-Homebuying-Dreams-in-2024-KCM-Share.png)