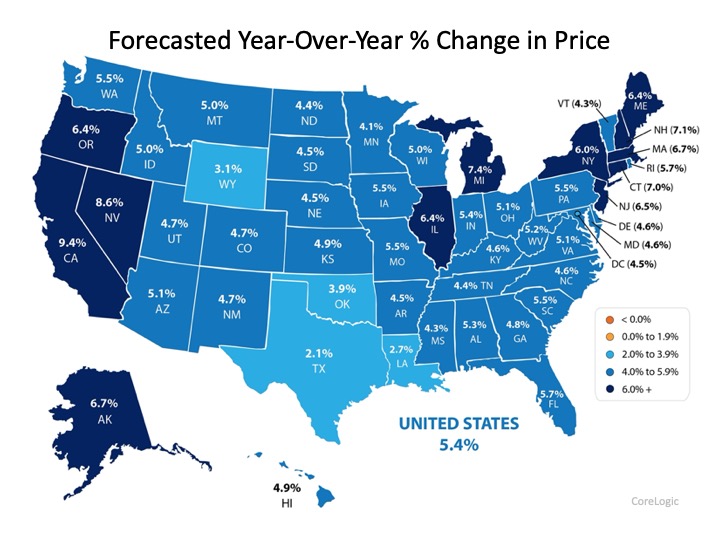

When closing out another year, it’s normal to wonder what’s ahead for the housing market. Though there will be future inventory issues, we expect interest rates to stay low and appreciation to continue.

Here’s what three experts are saying we’ll likely see in 2020:

Danielle Hale, Chief Economist at realtor.com

“I think the biggest surprise from the forecast is how long the market is staying in this low inventory environment, especially as Millennials are in a major home-buying phase…sellers will contend with flattening price growth and slowing activity with existing home sales down 1.8%. Nationwide you can look to flat home prices with an increase of less than 1%.”

Mike Fratantoni, Chief Economist at Mortgage Banker Association (MBA)

“Interest rates will, on average, remain lower…These lower rates will in turn support both purchase and refinance origination volume in 2020.”

Skylar Olsen, Director of Economic Research at Zillow

“If current trends hold, then slower means healthier and smaller means more affordable. Yes, we expect a slower market than we’ve become accustomed to the last few years…consumers will continue to absorb available inventory and the market will remain competitive in much of the country.”

As we can see, we’re still going to have a healthy market. It is forecasted to be a more moderate (or normal) market than the last few years, but strong enough for Americans to continue to believe in homeownership and to capitalize on the opportunities that come with low interest rates.

Bottom Line

If you’re wondering what’s happening in our local market, let’s get together today.

Source: KCM

![Working with a Local Real Estate Professional Makes All the Difference [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/12/19134136/20191227-Image-450x300.jpg)

![Working with a Local Real Estate Professional Makes All the Difference [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/12/19134109/20191227-MEM.jpg)

![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/12/19120857/20191220-Share-Image-571x300.jpg)

![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/12/19120754/20191220-MEM-scaled.jpg)