If you want to sell your house, having the right strategies and expectations is key. But some sellers haven’t adjusted to where the market is today. They’re not factoring in that there are more homes for sale or that buyers are being more selective with their budgets. And those sellers are making some costly mistakes.

Here’s a quick rundown of the 3 most common missteps sellers are making, and how partnering with an expert agent can help you avoid every single one of them.

1. Pricing the Home Too High

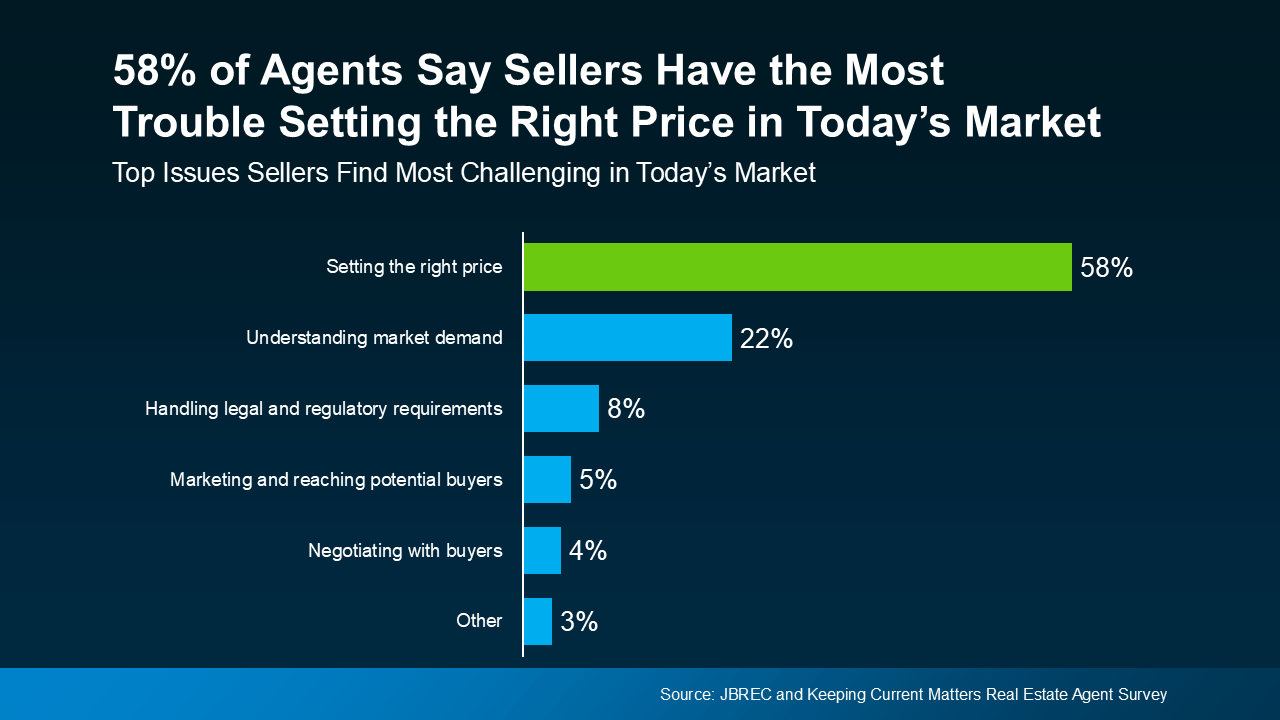

According to a survey by John Burns Real Estate Consulting (JBREC) and Keeping Current Matters (KCM), real estate agents agree the #1 thing sellers struggle with right now is setting the right price for their house (see graph below):

And more often than not, homeowners tend to overprice their listings. If you aren’t up to speed on what’s happening in your local market, you may give in to the temptation to price high so you can have as much wiggle room as possible to negotiate. You don’t want to do this.

And more often than not, homeowners tend to overprice their listings. If you aren’t up to speed on what’s happening in your local market, you may give in to the temptation to price high so you can have as much wiggle room as possible to negotiate. You don’t want to do this.

Today’s buyers are more cautious due to higher rates and tight budgets, and a price that feels out of reach will scare them off. And if no one’s looking at your house, how’s it going to sell? This is exactly why more sellers are having to do price cuts.

To avoid this headache, trust your agent’s expertise from day 1. A great agent will be able to tell you what your neighbor’s house just sold for and how that impacts the value of your home.

2. Skipping Repairs

Another common mistake is trying to avoid doing work on your house. That leaky faucet or squeaky door might not bother you, but to buyers, small maintenance issues can be red flags. They may assume those little flaws are signs of bigger problems — and it could cost you when offers come in lower or buyers ask for concessions. As Investopedia says:

“Sellers who do not clean and stage their homes throw money down the drain. . . Failing to do these things can reduce your sales price and may also prevent you from getting a sale at all. If you haven’t attended to minor issues, such as a broken doorknob or dripping faucet, a potential buyer may wonder whether the house has larger, costlier issues that haven’t been addressed either.”

The solution? Work with your agent to prioritize anything you’ll need to tackle before the photographer comes in. These minor upgrades can pay off big when it’s time to sell.

3. Refusing To Negotiate

Buyers today are feeling the pinch of high home prices and mortgage rates. With affordability that tight, they may come in with an offer that’s lower than you want to see. Don’t take it personally. Instead, focus on the end goal: selling your house. Your agent can help you negotiate confidently without letting emotions cloud your judgment.

At the same time, with more homes on the market, buyers have options — and with that comes more negotiating power. They may ask for repairs, closing cost assistance, or other concessions. Be prepared to have these conversations. Again, lean on your agent to guide you. Sometimes a small compromise can seal the deal without derailing your bottom line. As U.S. News Real Estate explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . the only way to come to a successful deal is to make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

The Biggest Mistake of All? Not Using a Real Estate Agent

Notice anything? For each of these mistakes, partnering with an agent helps prevent them from happening in the first place. That makes trying to sell your house without an agent’s help the biggest mistake of all.

Bottom Line

Avoid these common mistakes by starting with the right plan — and the right agent. Connect with an agent so you don’t fall into any of these traps.

Source: KCM