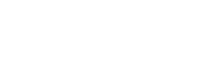

Last Friday, the U.S. Bureau of Labor Statistics released their May Employment Situation Summary. Leading up to the release, most experts predicted the unemployment rate would jump up to approximately 20% from the 14.7% rate announced last month.

The experts were shocked.

The Wall Street Journal put it this way:

“The May U.S. jobless rate fell to 13.3% and employers added 2.5 million jobs, blowing Wall Street expectations out of the water: Economists had forecast a loss of 8.3 million jobs and a 19.5% unemployment rate.”

In addition, CNBC revealed:

“The May gain was by far the biggest one-month jobs surge in U.S. history since at least 1939.”

Here are some of the job gains by sector:

- Food Service and Bartenders – 1,400,000

- Construction – 464,000

- Education and Health Services – 424,000

- Retail – 368,000

- Other Services – 272,000

- Manufacturing – 225,000

- Professional Services – 127,000

There’s still a long way to go before the economy fully recovers, as 21 million Americans remain unemployed. That number is down, however, from 23 million just last month. And, of the 21 million in the current report, 73% feel their layoff is temporary. This aligns with a recent Federal Reserve Bank report that showed employers felt 75% of the job losses are temporary layoffs and furloughs.

The Employment Situation Summary was definitely a pleasant surprise, and evidence that the country’s economic turnaround is underway. The data also offers a labor-market snapshot from mid-May, when the government conducted its monthly survey of households and businesses. Many states did not open for business until the second half of May. This bodes well for next month’s jobs report.

Bottom Line

We cannot rejoice over a report that reveals millions of American families are still without work. We can, however, feel relieved that we are headed in the right direction, and much more quickly than most anticipated.

Source: KCM

![National Homeownership Month [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2020/06/04170941/20200605-KCM-Share-549x300.jpg)

![National Homeownership Month [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2020/06/04170906/20200605-MEM.jpg)

![Top Reasons to Own Your Home [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2020/05/28170014/20200529-Share-571x300.jpg)

![Top Reasons to Own Your Home [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2020/05/28165935/20200529-MEM.jpg)