As a homeowner, it’s always tempting to dream about the next big project you’re going to tackle. The possibilities are endless. Should I renovate? Should I refinance? Should I stay? Should I move? The list goes on and on.

In today’s housing market, it’s actually a great time to shift your thoughts toward selling your house and moving up into the home of your dreams. Here’s why:

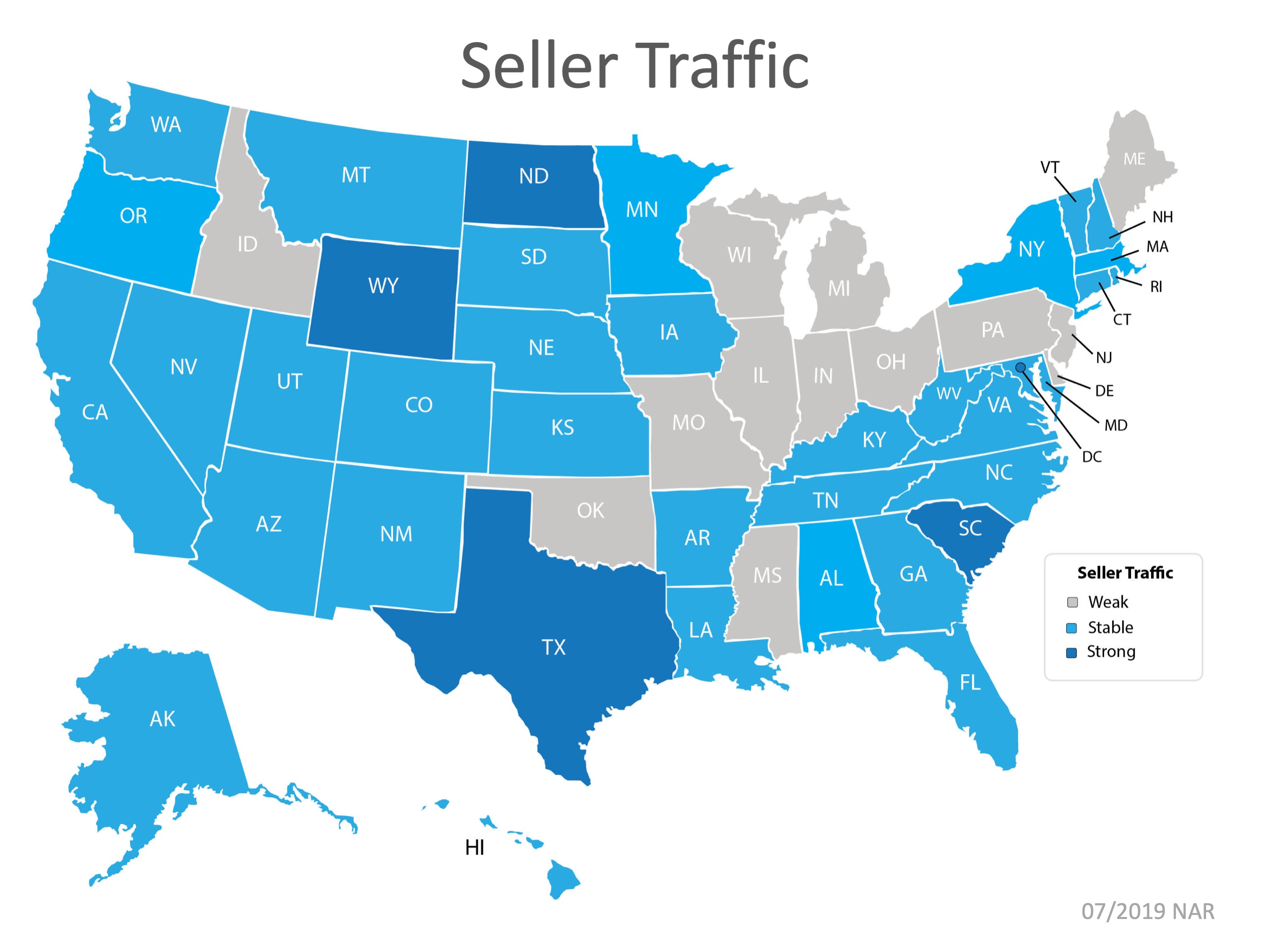

Inventory is on the rise, but there’s still an overall shortage of houses for sale (less than a 6-month supply found in a more normal market), so homes are going under contract quickly. In fact, the National Association of Realtors (NAR) Realtors® Confidence Index Survey reports that right now homes are only staying on the market for an average of 27 days. That’s less than one month, an even more accelerated pace from the 36-day trend we saw last spring. The same report also indicates there are more interested buyers than active sellers today, which is one of the big factors driving home prices higher.

The same report also indicates there are more interested buyers than active sellers today, which is one of the big factors driving home prices higher.

This power combination provides an ideal environment for sellers aiming to close a quick sale and earn a big return as we wrap up the summer season.

This power combination provides an ideal environment for sellers aiming to close a quick sale and earn a big return as we wrap up the summer season.

Bottom Line

There’s still time to make a move before the school year starts and the fall weather sets in. Maybe it’s time to make a change. Let’s get together to determine if selling now is the right decision for your family.

Source: KCM

![Home Prices up 5.05% Across the Country! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/07/15142518/20190726-Share-KCM-549x300.jpg)

![Home Prices Up 5.05% Across the Country [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/07/25113005/20190729-MEM.jpg)

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/07/15125928/20190719-Share-KCM-571x300.jpg)

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/07/15125704/20290719-MEM.jpg)